Global demand for specific Himalayan salt products is projected to hit USD 528 million in 2025, driven by a strong 6.1% CAGR in the United States. However, securing a profitable position in this market requires navigating the steep cost differential between direct factory FOB pricing—averaging $7.50 to $9.20 per unit—and the convenience markups applied by domestic trading houses. This guide eliminates the noise around “pink salt” procurement, focusing strictly on the mineral density and logistics required to scale authentic inventory.

We contrast the production capacities of direct manufacturers like PakSons International and Lingshou County Xuyang against the logistical flexibility of aggregators such as Salt Wonders USA. Beyond pricing, we dissect the critical quality control standards necessary to prevent returns, including A+ Grade crystal clarity, moisture-resistant Neem wood bases, and mandatory UL/CE electrical certifications. You will learn how to leverage the 300-unit MOQ threshold to access OEM customization and secure durable, export-ready packaging.

The Global Demand for Himalayan Salt

Global demand hits USD 528 million in 2025, driven by 6.1% US growth and expanding industrial applications beyond premium food retail.

Market Valuation and Consumption Drivers

Reliable sourcing strategy requires distinguishing between broad “pink salt” categories and core Himalayan extraction. Realistic estimates peg the specific Himalayan market at USD 528 million for 2025. Projections suggest a climb to USD 868.3 million by 2035 at a 5.1% CAGR. While some reports cite valuations as high as USD 12.8 billion, these figures conflate general iodized salt and broad food/beverage sectors. For B2B procurement, the sub-USD 1 billion figure represents the actionable market baseline.

The “clean-label” movement drives this specific volume. Food processors increasingly substitute processed sodium for Himalayan varieties to market the presence of over 80 trace minerals. This shift pushes food-grade salt as the leading segment, moving volume away from generic table salt toward mineral-rich alternatives.

Regional Hotspots and Industrial Applications

North America dictates the consumption pace. The United States leads expansion with a 6.1% CAGR, establishing the primary import channel for both food-grade granules and wellness products. Europe and Asia follow with steady, mature growth rates through 2035.

- USA: 6.1% CAGR (Regional Leader)

- Germany: 4.7% CAGR

- Japan: 4.6% CAGR

- UK: 4.5% CAGR

- France: 4.1% CAGR

Beyond retail, industrial applications stabilize wholesale volume. Chemical processing and water treatment facilities now utilize natural salts to meet environmental compliance standards. This industrial demand supplements the premium pink salt segment, which alone accounts for over USD 246 million in market value.

Factory vs. Trading Company

Direct sourcing reduces unit costs to $7.50–$9.20 but demands high MOQs. Trading companies justify higher markups with domestic warehousing and access to sub-300 unit orders.

| Feature | Direct Factory (e.g., PakSons, Xuyang) | Trading Company (e.g., Salt Wonders) |

|---|---|---|

| FOB Pricing | $7.50 – $9.20 / unit | Factory Price + Reseller Markup |

| MOQ Requirement | High (500+ units or 26 tons) | Low (Under 300 units) |

| Production Control | Full oversight (Custom shapes/Mining) | None (Aggregated Stock) |

| Logistics | FOB/EXW (Buyer handles import) | DDP/Domestic (US Warehousing) |

Direct Manufacturer Capabilities vs. Trading Intermediary Services

Factories like PakSons International and Lingshou County Xuyang own their production lines. They control raw material access—often claiming direct sourcing from the Khewra Salt Mine—and operate massive facilities exceeding 86,000 m². These manufacturers focus on high-volume capacity and technical customization, allowing buyers to dictate specifications right at the source.

Trading companies, such as Salt Wonders USA or Nature’s Decor, function as aggregators. They buy finished goods from various factories, add a margin, and handle the import logistics. You pay them for convenience, US-based warehousing, and value-added services like private labeling. They rarely possess direct production oversight, meaning they sell what they have in stock rather than what you might specifically engineer.

Comparative Economics: Pricing Structures, MOQs, and Quality Control

Direct sourcing wins on pure cost. Eliminating the middleman enables FOB prices between $7.50 and $9.20 per unit. The trade-off is volume. Factories operate on scale, prioritizing 26-ton raw material orders or production runs exceeding 500 units. This model suits established brands capable of managing international freight and inventory risk.

Traders fit buyers needing fewer than 300 pieces. You avoid the risk of importing a container of potentially broken lamps, but you lose transparency regarding the mine-direct origin. Operational metrics from Chinese manufacturers highlight the gap in reliability and scale:

- On-Time Delivery: Established factories demonstrate rates around 97.5%.

- Reorder Rates: Manufacturers maintain approximately 28% reorder rates, indicating consistency.

- Customization: Direct access allows for specific carving shapes (e.g., hearts, pyramids) vs. generalized stock.

Key Quality Indicators (Color, Base, Cord)

Authentic quality relies on iron oxide content for color, A+ Grade clarity for light output, and moisture-resistant Neem wood bases to prevent structural rot.

| Component | High Quality Indicator | Failure Point / Low Grade |

|---|---|---|

| Mineral Content | Rich Iron Oxide (Orange/Pink) | Pale White (High NaCl, Low Mineral) |

| Crystal Clarity | A+ Grade (Translucent) | Opaque / Blocky Rock |

| Base Material | Neem Wood (Rot Resistant) | Particle Board (Absorbs Moisture) |

| Compliance | UL / CE / RCM Certified | No Stamp / Thin Insulation |

Visual Grading: Color Spectrum and A+ Clarity Analysis

Color is a direct result of mineral density. Trace iron oxide creates the signature pink-to-orange hues found in authentic Himalayan salt. Deep orange lamps work best for mood lighting and stress relief, while lighter pink variants contain less iron and allow higher lumen output for functional illumination.

Clarity separates premium stock from standard rock. A+ Grade salt is translucent, allowing light to pass through the crystal structure unobstructed. Lower-grade rock is opaque and blocks the bulb’s glow, resulting in a dull, heavy appearance rather than a warm ambiance.

- Striations: Natural, uneven lines confirm the salt grew organically rather than being manufactured.

- Texture: Rough, non-uniform surfaces distinguish mined rock from polished glass counterfeits.

- Light Diffusion: A+ Grade crystals diffuse light evenly; inferior grades show dark spots or complete blockage.

Hardware Integrity: Base Materials and Electrical Safety Certifications

Salt is hygroscopic; it pulls moisture from the air and “sweats.” This physical reaction destroys cheap bases. You need dense, rot-resistant materials like hand-polished Neem wood to withstand constant dampness without warping or growing mold. Standard softwoods or particle boards will fail structurally under these conditions.

Electrical safety is the primary liability risk in this category. Cheap cords overheat or short out when salt deliquescence corrodes the socket. B2B buyers must verify certification stamps directly on the cord and plug, not just the packaging.

- North America: Cords must carry UL certification marks to meet insurance requirements.

- Europe: Look for CE compliance stamps on the plug and switch.

- Australia/NZ: RCM stamps are mandatory for cords, plugs, and dimmers.

- Socket Safety: Insulation must seal the bulb housing against moisture ingress.

Source Premium Himalayan Salt Lamps Direct from the Factory

Most Profitable Shapes

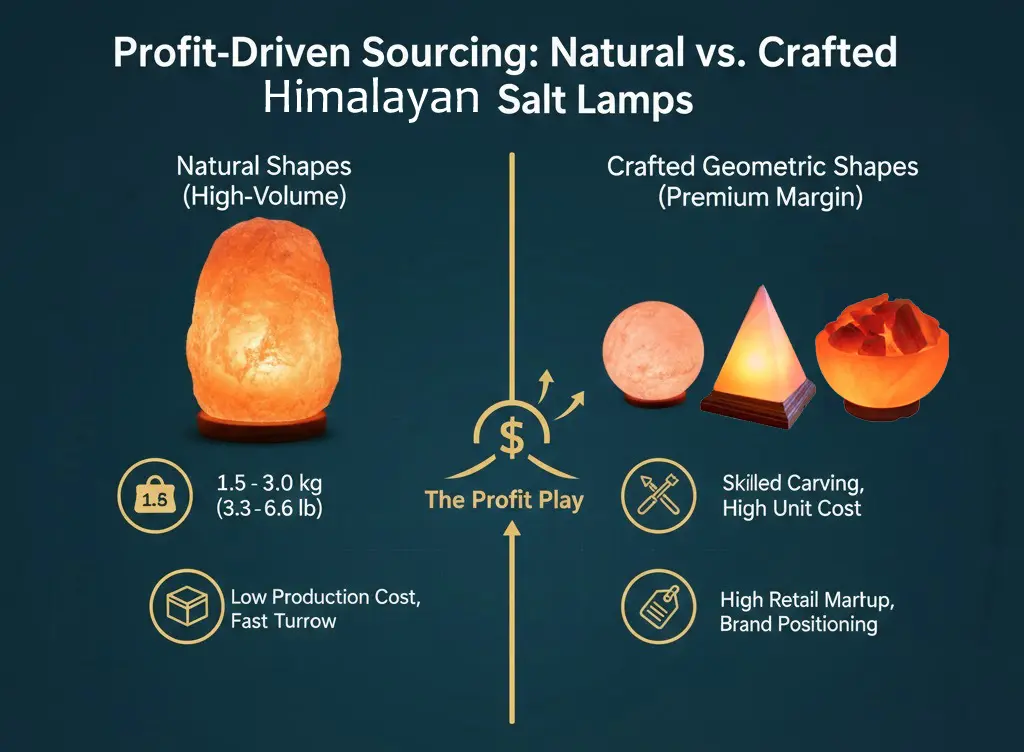

Retail profitability relies on high-velocity Natural Shapes (1.5–3.0 kg) for volume and precision-carved Geometric Forms for premium margins.

Core Market Categories: Natural vs. Crafted

Retailers generally split inventory between two distinct product classes to balance cash flow and margin. Natural Shapes retain the raw, organic aesthetic of the mine. These units drive the highest sales velocity because they require minimal processing, which keeps production costs and wholesale rates low. Since less material is wasted during extraction, factories can supply these in bulk at aggressive price points.

In contrast, Crafted Geometric Shapes target the modern home décor market. Skilled artisans carve these forms—Spheres, Pyramids, and Rectangles—from raw blocks. While this labor increases the wholesale unit cost, the precise finish allows for significantly higher retail markup percentages compared to raw cuts. Brands typically use natural shapes for turnover and geometric shapes for brand positioning.

Technical Specifications & Dimensions

Understanding the exact dimensions of best-selling units prevents shipping miscalculations and ensures shelf compatibility. The following specifications represent the standard output for major manufacturing hubs in Pakistan:

- Natural Shapes (High Volume): Wholesale shipments prioritize the 1.5–2.0 kg (~3.3–4.4 lb) and 2.0–3.0 kg (~4.4–6.6 lb) weight brackets.

- Rectangle (Code SL-350): Standard cuts measure 4″ L x 4″ W x 7″ H with a gross weight near 8.00 lb.

- Sphere (Full Moon): Typical specifications are 5″ H x 5″ D, usually mounted on wooden bases.

- Pyramid & Raindrop: Common heights range from 6 to 10 inches, weighing between 5 and 7 lbs depending on specific salt density.

Packaging Standards for Export

Export packaging splits into bulk formats for industrial buyers and custom retail boxes. Heavy items require reinforced wooden bases and moisture control to prevent transit damage.

Bulk vs. Retail-Ready Formats

Importers choose between two distinct streams based on their final sales channel. Industrial buyers prioritize density and protection, utilizing heavy-duty formats that maximize container utilization and minimize moisture ingress. Conversely, consumer brands opt for “shelf-ready” solutions, defining box schematics and branding before the goods ever leave the factory.

- Bulk Configurations: Heavy-duty bags, jars, and pouches designed for immediate repackaging or industrial use.

- Retail Customization: Private labelling services allow importers to specify design and eco-friendly materials.

- Minimums: Custom retail configurations typically carry an MOQ of 50 units per design.

Safety Protocols and Compliance for Transit

Shipping distinct geological formations requires engineering, not just cardboard. Salt is hygroscopic; it pulls moisture from the air. Without specific barriers, products will “weep” or degrade during long ocean transits. Structural integrity is also a massive risk for larger specimens, which act like brittle stone under stress.

- Heavyweight Stabilization: Jumbo lamps, weighing up to 1,000 lbs, utilize reinforced wooden bases and programmable lighting mounts to prevent internal fracture.

- Moisture Control: Sealants and desiccants are mandatory to stop humidity from compromising the crystal structure.

- Regulatory Compliance: Packaging must meet destination country requirements, specifically for safety labelling and electrical certification on lamp cords.

Pricing Tiers & MOQ (300pcs)

A 300-unit order bridges the gap between expensive case packs and full pallets, securing 20-40% better margins and enabling OEM branding.

Defining Wholesale Tiers: From Case Packs to Full Pallets

Suppliers typically structure pricing across three distinct levels to manage logistics and inventory turnover. Understanding these brackets prevents overpaying for mid-sized inventory needs.

- Level 1 (Per Piece): High markup, used for samples or dropshipping.

- Level 2 (Case Quantity): Standard wholesale entry point, prices vary by model.

- Level 3 (Pallet Quantity): Distributor rates, usually requiring a minimum of 20 cases.

The 300-unit mark serves as a critical entry point. It allows buyers to bypass “per-piece” premiums without committing to full container loads. At this tier, pricing generally includes standard white box packaging and shrink-wrapping, optimized for pallet consolidation rather than loose parcel shipping.

The 1000-Piece Advantage: Accessing OEM & Bulk Margins

Hitting the 1000-piece threshold shifts leverage from the supplier to the buyer. Manufacturing data indicates this is the specific volume where factories accept OEM requests, allowing retailers to specify wood base types, custom shapes, and packaging branding.

Case Study: Helping a Retailer Scale

Scalable growth demands ISO 9001 certified consistency and moisture-proof packaging to bridge the gap between 50-unit test orders and high-volume container shipments.

From Market Testing to Mass Distribution

Retailers typically validate market demand through low Minimum Order Quantities (MOQs). Starting with small batches of 50 units allows you to test specific shapes, such as the 2-3kgs Natural Shapes, without committing heavy capital to unproven inventory.

Scaling this model introduces consistency challenges. You cannot manually inspect thousands of units for uniformity. Success at this stage relies on ISO 9001:2018 certified sorting processes to ensure every lamp matches in color density and structural integrity. Your manufacturing partner must also demonstrate the capacity to handle diverse inventory needs, ranging from standard retail units to 88-110 lb wholesale display pieces.

Operational Solutions: Packaging and Compliance

Salt is hygroscopic, meaning it naturally absorbs water from the air. Without rigorous moisture management, shipments degrade and “sweat” during ocean freight, leading to rejected stock upon arrival. We implemented strict technical protocols to secure global logistics and retail acceptance:

- Moisture Defense: Units are shrink-wrapped with commercial moisture absorbers to prevent degradation in humid shipping containers.

- Regulatory Compliance: All assemblies use UL-listed cords and switches tested for continuous operation under 40W.

- Standardized Sorting: Strict weight classes (e.g., 5-7 lbs vs. 8-10 lbs) eliminate shelf variability, a primary pain point for large-scale importers.

Final Thoughts

Direct vs. Trading: Balance the high-reward complexity of direct factory sourcing against the ease and speed of local trading partners when building your Himalayan salt lamp business.

Scaling Sustainably: Aim for a volume that justifies private labeling to build brand equity. Regardless of your sourcing route, ensure your products meet global safety standards and utilize high-durability hardware to withstand environmental factors.

Experience the quality firsthand with our low-threshold trial order – a risk-free way to test these high-margin products in your market. Get in touch to start your flexible trial today!

Frequently Asked Questions

Do wholesale suppliers offer drop shipping for salt lamps?

Yes. Many suppliers support drop shipping by handling storage and direct delivery to end customers. Note that this model typically incurs fulfillment costs 2-4% higher than standard bulk shipping rates.

What is the difference between wholesale and retail margins?

Wholesale transactions usually operate on 15-30% profit margins with minimum order quantities (MOQs) and extended payment terms (e.g., Net 30). Retail sales target 30-50% margins on individual units with immediate payment.

Can I obtain samples before placing a large order?

Factories routinely provide samples. For custom OEM orders, manufacturers often enforce a specific sample MOQ (around 50 units) to verify the full assembly, including UL-approved cords and bases.

How can I prevent lamps from ‘sweating’ or melting during shipping?

Moisture condensation occurs if relative humidity (RH) exceeds 60%. To prevent this, shipments must use desiccants and sealed moisture-proof packaging (shrink wrap) to maintain an internal environment of 40-60% RH.

What is the HS Code for exporting Himalayan salt lamps?

The standard Harmonized System (HS) code for electric light fixtures containing salt rocks and metal bases is 94054990.00

Is white-label packaging available for private brands?

Yes, manufacturers offer white-labeling to rebrand pre-manufactured items. Packaging must meet durability standards (e.g., 49 CFR 172.407) and often aligns with GMP certification requirements for quality assurance.